Everyone needs membership card to get in. Why are Sam and Costco so popular in China?

The always low-key and quiet Wal-Mart Sam’s Club suddenly went viral. In recent months, TIK TOK will appear from time to time some short videos of Wal-Mart’s Sam’s Club. In the videos, Internet celebrity roast chicken, mochi buns, red velvet cake, durian layer cake, big strawberries, cherries, Several Internet celebrity SKUs continue to bombard the public’s senses. As a result, the Sam’s Club has ushered in a large wave of customers around the Spring Festival. According to Jiemian News, during the Spring Festival, the parking lot of Beijing Shijingshan Sam’s Club is half full before 9 o’clock every day. In many Sam’s Clubs, roast chicken and durian layer cake are popular products. It was swept away almost as soon as it was new. On weekends, there are plenty of “spectacles” in Sam’s Club that spends an hour in line to buy roast chicken, and another half an hour to check out. But in fact, the paid membership system entered China as early as 1996, but it has been in the exploratory stage for more than 20 years, and even many companies have canceled the paid membership system in the process. So is the paid membership system suitable for China’s national conditions, and why has it been in a tepid state before?

Let me first talk about the performance of membership-based super companies in China.

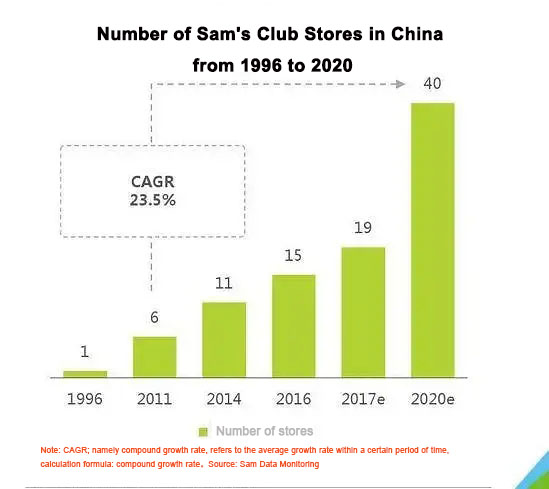

Pay membership-based warehouse supermarkets entered China in 1996. At that time, “membership-based retail” was not well-known in China, but in the 1980s, Europe and the United States had developed for more than ten years. On August 12, 1996, the first Sam’s Club in China landed in Shenzhen. Only paying to become a member can enter the supermarket to shop. The paid membership companies that entered China at the same time as Sam included Metro, Pricemart, etc., but many of them ceased to adhere to the paid membership model or even withdrew from the Chinese market. For example, Metro canceled the paid membership system in 2010, and individual and corporate users Direct access to shopping; Pricemart was completely closed in China in March 2005 due to capital chain problems. So far, only Sam’s Club among foreign investors who entered China in the early stage still adheres to the paid membership system. The strange thing is that Sam’s Club has been in a quiet state after entering the country. Until 2011, there were only 6 stores nationwide, but it ushered in growth in 2016. Sam quickly expanded to 16 stores in 2016 and is expected to reach 40 stores in 2020. The reason behind Sam’s decision to expand is the growth of Sam’s sales in China. Wal-Mart China’s total sales in the fourth quarter of 2016 increased by 5.4%, and the driving force for Wal-Mart’s sales growth mainly came from hypermarkets and Sam’s Club (ps: Sam’s Club’s parent company is Wal-Mart).

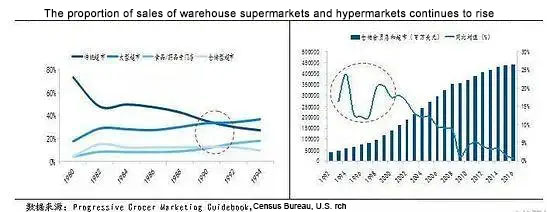

So the question is, why did the membership-based company Super Neng, represented by Sam’s Club, suddenly grow against the trend after 2016? Let’s take a look at the development history of membership-based supermarkets in the United States, where it originated, and trace the growth logic behind it to verify why it has grown rapidly in China in recent years and what its future trend will be. What kind of business is a membership-based warehouse supermarket? Take Costco as an example. The membership-based warehouse supermarket originated in the United States. From the 1950s to the 1990s, with the rapid economic development, the American people’s wallets also swelled. The supermarket industry At the same time of rapid expansion, business segmentation appeared, and Costco was born and grew in this wave. In 1983, the first Costco store opened in Seattle, the United States. Subsequently, Costco opened its doors in regions with more middle-class families such as Europe, America, and East Asia. It is inevitable that membership-based super can take root in developed markets and continue to develop.

First, consumers in developed regions are generally not priced sensitive. Take the United States as an example. Costco’s membership fee of several tens of dollars will not cause “price anxiety” even for low- and middle-income groups. Secondly, membership-based supermarkets represented by Costco specialize in large-package products, which are in line with the needs of relatively large European and American families; in addition, unlike Chinese families who like fresh food, European and American families living in suburbs are accustomed to concentrate purchases on weekends. , The diversity of goods in membership-based warehouse supermarkets can help families complete one-stop shopping efficiently. From the perspective of the business model, membership-based warehouse supermarkets such as Costco are quite different from traditional supermarkets. Most of the profits of traditional supermarkets come from the difference between the purchase price and the selling price of the goods. In overseas, membership-based warehouse supermarkets regard the price of goods as a guide: while selecting in-store goods, supermarkets will actively reduce the gross profit margin of goods and use the strategy of “low-price selection” to attract a large number of consumers.

Up to this point, this business model is not much different from Xiaomi. The fact is that the key point of the profitability of a member warehouse supermarket is not “selling goods”, but the membership fee system that Chinese consumers question from time to time. Membership fees are crucial to the profitability of warehouse supermarkets. According to Guotai Junan Securities, in 2000, membership fee income accounted for 52% of Costco’s operating profit. By 2017, membership fee income accounted for 69% of operating profit. About 70%, it can be seen that Costco is essentially a membership fee business. In order to ensure continued growth, Costco’s membership fee is not a set of standards to use to the end. First of all, Costco’s membership is divided into four types: ordinary individuals, elite individuals, ordinary business, and elite business. The fees for ordinary members and elite members are different. For Costco, it can maximize the income of membership fees and reduce all consumption levels. Of customers are included.

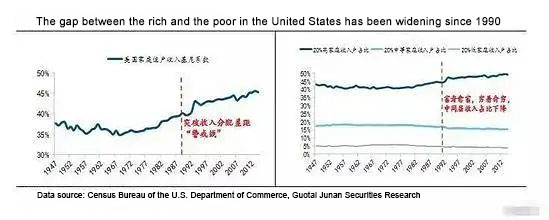

So, why did American membership-based supermarkets experience rapid growth in the 1990s? This is due to the economic background at the time. Since 1990, the national income gap in the United States has been increasing. The Gini coefficient of American household income broke the 0.4 warning line in 1988 and has since continued to rise. ps: The Gini coefficient is an indicator used to measure the national income gap. A higher than 0.4 indicates a large gap between the rich and the poor. The income of low- and middle-income families has dropped significantly, and 50% of the people believe that the living standards of the next generation will be worse than the current one. It is in this economic environment that the people’s rational consumption consciousness has begun to recover, Americans’ brand awareness has gradually faded, price awareness has returned, and consumption concepts have shifted from advocating brand names to advocating cost-effectiveness.

The background of the era of high Gini coefficient and rational consumption coincides with the ultra-high cost-effective operating characteristics of membership-based companies. Therefore, membership-based companies have experienced rapid growth in the 1990s. From the perspective of Wal-Mart China’s overall situation, Sam’s importance is also increasing. Since 2016, Wal-Mart has closed stores in China one after another and has closed 80 stores so far. However, the poor market performance has led to frequent changes in Wal-Mart China. Within three years, Wal-Mart China has changed its CEO, chief purchasing officer, e-commerce business leader, and other senior executives. Compared with its local rival Yonghui and online JD supermarkets, Wal-Mart China’s performance is not impressive, and the traditional supermarket business is even shrinking. This has caused Wal-Mart to look for profit growth points other than the supermarkets. The popularity and continued expansion in southern China may mean that the explosive point of membership-based supermarkets in China has arrived. As the earliest membership-based supermarket with the largest number of stores in China, the advantages of Sam’s Club are self-evident. This is enough to show that membership cards are still indispensable in a commercial society today. If you need a customized membership card, please contact us!

The background of the era of high Gini coefficient and rational consumption coincides with the ultra-high cost-effective operating characteristics of membership-based companies. Therefore, membership-based companies have experienced rapid growth in the 1990s. From the perspective of Wal-Mart China’s overall situation, Sam’s importance is also increasing. Since 2016, Wal-Mart has closed stores in China one after another and has closed 80 stores so far. However, the poor market performance has led to frequent changes in Wal-Mart China. Within three years, Wal-Mart China has changed its CEO, chief purchasing officer, e-commerce business leader, and other senior executives. Compared with its local rival Yonghui and online JD supermarkets, Wal-Mart China’s performance is not impressive, and the traditional supermarket business is even shrinking. This has caused Wal-Mart to look for profit growth points other than the supermarkets. The popularity and continued expansion in southern China may mean that the explosive point of membership-based supermarkets in China has arrived. As the earliest membership-based supermarket with the largest number of stores in China, the advantages of Sam’s Club are self-evident. This is enough to show that membership cards are still indispensable in a commercial society today. If you need a customized membership card, please contact us!

CXJ

CXJ CXJ

CXJ